Pre-Seed Investing

We follow a unique philosophy of early-stage investing by partnering up with founders starting from day one.

We support founders in the early days of founding their business with knowledge, contacts, and operational support without asking for any commitments. Our goal is to connect talented & passionate people while serving as an entrepreneurial sparring partner and fostering an exchange between new and seasoned founders within the startup community. We typically collaborate with founders who have strong academic and professional backgrounds, often involving serial entrepreneurs, to establish successful and sustainable category leaders.

We focus on working with independent and founder-driven companies. Our potential Pre-Seed investment offer upon the foundation of a company remains optional for the entrepreneurs to accept. This clearly differentiates our investment approach from incubation or accelerator programs. After a potential Pre-Seed investment, the offering for entrepreneurs doesn’t stop. We provide substantial support for our Pre-Seed portfolio companies to reach and cross the inflection point.

Pre-Seed investment team.

finetune the concept and get investor feedback regarding the respective funding

environment early on.

Our Pre-Seeds

We invest in strong business models and teams from day one to establish successful and sustainable category leaders.

“From early on, Picus has been a great sparring partner and helped us kick-off our go-to-market phase fast and successfully. Their network and operational support enabled us to attract exceptional talent quickly and set Hive up for rapid growth.”

Strategic Partners

Strategic sparring in the concept ideation and operative support in the go-to-market phase including the set-up of the initial warehouse operationsFundraising

Tiger Global Management, Activant Capital, Earlybird Venture Capital, Amplifier Ventures, Picus CapitalDebt Access

n/aHR & Recruiting

Involvement in the hiring of several key management roles such as the Head of Growth, Head of Ops & Head of Account Management as well as various FTEs & interns leveraging the Picus network & HR resources

”The Picus team was instrumental in building up the initial operations at Workmotion in the early days. But their true value became clear when Picus leveraged their global network of AAA investors for our fundraising: There was not one fund that didn’t take a call with us.”

Strategic Partners

Strategic sparring in the concept ideation and hands-on support in the go-to-market phase leveraging Picus' global networkFundraising

Activant Capital, XAnge, Carsten Maschmeyer (seed+speed), Niklas Östberg (Delivery Hero), Jochen Engert (Flixbus), Victor Jacobsson (Klarna), Hanno Renner (Personio), Picus CapitalDebt Access

n/aHR & Recruiting

Strongly supported hiring of co-founder / COO and first key FTEs leveraging Picus network & HR resources

”From the first meeting we knew Picus is the right partner for us. They understand what it takes to build an industry defining company and in the early days they were almost like a 4th co-founder to us. They knew how to support us and how to amplify our capabilities both strategically and operationally.”

Strategic Partners

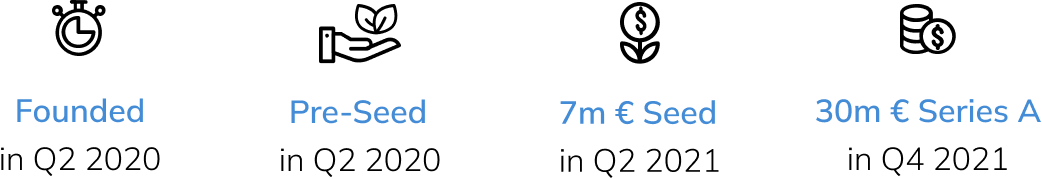

Strategic sparring in the concept ideation and operative support in the go-to-market phase leveraging the extensive HealthTech expertise and network of PicusFundraising

Heal Capital, Vorwerk Ventures, IDInvest, flatiron founder, Picus CapitalDebt Access

Access to substantial initial debt line to acquire hospital and introduction of the company to relevant follow-up debt providers & advisors resulting in follow-up debt linesHR & Recruiting

Involvement in the hiring of co-founder / COO and Founders Associate leveraging the Picus network & HR resources

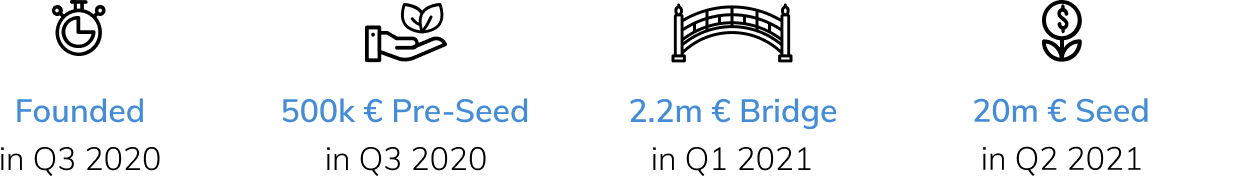

„Picus supported us with their comprehensive market understanding in the early phases of building our business and has been an excellent sparring partner for us ever since.“

Strategic Partners

Strategic sparring in the concept ideation and operative support in the go-to-market phase leveraging the extensive PropTech and global iBuyer model expertise of PicusFundraising

Greenoaks Capital, Project A, 360 Capital Partners, Picus CapitalDebt Access

Access to substantial initial debt line to finance Real Estate efficiently and introduction of the company to relevant follow-up debt providers & advisors resulting in follow-up debt linesHR & Recruiting

Involvement in the hiring of the Head of Italy and the Head of Spain leveraging the Picus network & HR resources“Picus is an exceptional partner for our firm when it comes to the ambition to build a global category leader and to recruit top talent for our organization.”

Strategic Partners

Strategic sparring in the concept ideation and operative support in the go-to-market phase leveraging the extensive Real Estate expertise and network (e.g. broker access) of PicusFundraising

Lakestar, Holtzbrinck Ventures, Picus CapitalDebt Access

Access to substantial initial debt line to finance rent deposits & furniture efficiently and introduction of the company to relevant follow-up debt providers & advisors resulting in follow-up debt linesHR & Recruiting

Involvement in the hiring of the VP Operations, the VP Business Development, the CFO and various FTEs & interns leveraging the Picus network & HR resources

“We were amazed by the comprehensive market understanding and broad industry network of Picus which helped us tremendously with our go-to-market strategy and to acquire our first customers.”

Strategic Partners

Strategic sparring in the concept ideation and operative support in the go-to-market phase leveraging the extensive PropTech expertise and Real Estate network (e.g. broker access) of PicusFundraising

Holtzbrinck Ventures, DN Capital, Picus CapitalDebt Access

Access to substantial initial debt line to finance office equipment efficiently and introduction of the company to relevant follow-up debt providers & advisors resulting in follow-up debt linesHR & Recruiting

Involvement in the hiring of the COO, the CCO, the first FTEs and various interns leveraging the Picus network & HR resources“Picus’ deep FinTech expertise and network contributed to the structure of our product offering today and was a key element to finance our business on the equity and debt side in the early days.”

Strategic Partners

Strategic sparring in the concept ideation and operative support in the go-to-market phase leveraging the extensive PropTech & FinTech and global home equity loan model expertise of PicusFundraising

Global Founders Capital, Zalando Founders (David Schneider, Robert Gentz & Rubin Ritter), Picus CapitalDebt Access

Access to substantial initial debt line to finance Real Estate loan portfolio efficiently and introduction of the company to relevant follow-up debt providers & advisors resulting in follow-up debt linesHR & Recruiting

Involvement in the hiring of the VP Operations & Customer Experience, the VP Growth, the VP Strategic Projects, the Head of Data Science, the Head of Compliance and various FTEs & interns leveraging the Picus network & HR resources

“Picus has been an exceptional strategic sparring partner in the early days and ever since. We in particular worked closely together with them to solve the complex financing challenges inherent in our business model.”

Strategic Partners

Strategic sparring in the concept ideation phase and ongoing support leveraging the extensive Renewable Energies and financial planning expertise of PicusFundraising

Princeville Capital, Zalando Founders (David Schneider, Robert Gentz & Rubin Ritter), Lukasz Gadowski, Picus CapitalDebt Access

Access to substantial initial debt line to finance solar systems efficiently and introduction of the company to relevant follow-up debt providers & advisors resulting in follow-up debt linesHR & Recruiting

Involvement in the hiring of the COO, the VP Corporate Finance, the Head of Controlling, the Head of Project Finance, the Head of Operations & Assembly leveraging the Picus network & HR resourcesOur Pre-Seed Investments In Numbers

Casavo – A Founder Story

Get inspired by the entrpreneurial journey we are taking with our portfolio company Casavo – a proptech offering and instant buyer platform founded by Giorgio Tinacci in Milan.

Our Pre-Seed Portfolio

Check out with which ventures we initially partnered in Pre-Seed stage.